EUR/USD Forecast: A modest USD retracement helps defend 1.1300 handle, for the time being

The EUR/USD pair remained under heavy selling pressure for the third consecutive session on Wednesday and revisited YTD lows key support at the 1.1300 handle. The pair did get a minor lift following the release hotter-than-expected advanced Euro-zone inflation figures, showing that the headline CPI accelerated to 2.2% y/y and core CPI climbed to 1.1% y/y in October. The uptick quickly ran out of steam amid resurgent US Dollar demand, supported by stronger than expected US private sector employment details.

The US ADP report showed private-sector employers added 227K new jobs in October, higher than 189K expected and previous month's downwardly revised reading of 218K. Adding to this, the employment cost index rose more than expected by 0.8% in Q3 and triggered a fresh leg of an upsurge in the US Treasury bond yields, which underpinned the greenback demand and turned out to be one of the key factors exerting downward pressure on the major.

The pair, however, once again managed to find decent support near the 1.1300 round figure mark and staged a solid rebound during the Asian session on Thursday. The rebound lacked any obvious fundamental catalyst and could be solely attributed to a modest USD retracement from near 17-month tops. Today's US economic docket highlights the release of ISM manufacturing PMI and will be looked upon for some short-term trading impetus ahead of this week's other important macroeconomic releases, including the keenly watched NFP, scheduled at the start of a new month.

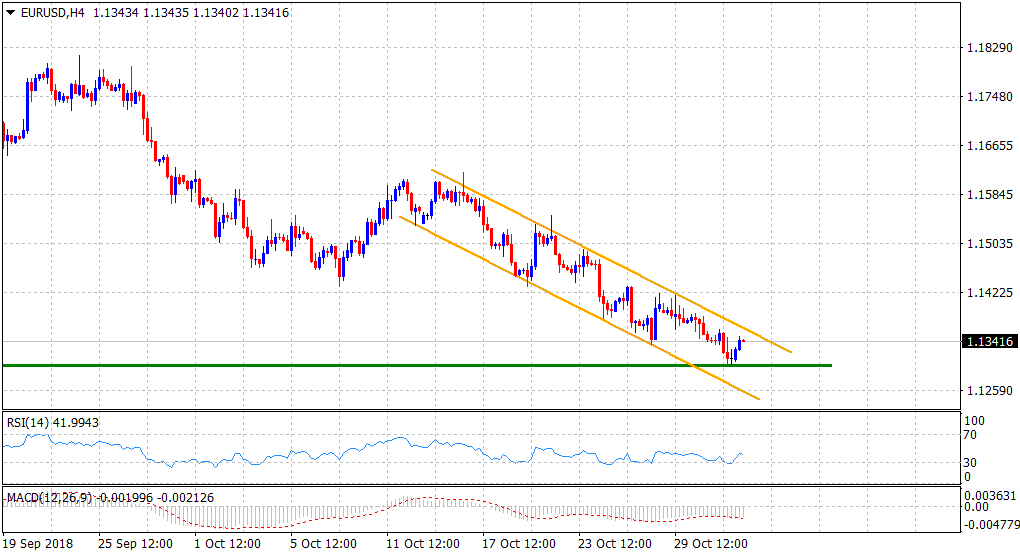

From a technical perspective, the ongoing rebound could be seen as initial signs of bearish exhaustion and might prompt some additional short-covering. A follow-through move beyond a short-term descending trend-channel resistance, currently near the 1.1360 region, will reinforce the expectations and accelerate the up-move further towards reclaiming the 1.1400 handle. The recovery move could further get extended towards retesting the 1.1425-30 heavy supply zone.

Alternatively, failure to make it through the trend-channel hurdle might prompt some aggressive selling and turn the pair vulnerable to finally confirm a fresh bearish break below the 1.1300 handle. Below the mentioned support, the pair is likely to accelerate the fall towards testing the trend-channel support, currently near the 1.2755-50 region.

___________________________________________________________________________

BEST FOREX TRADING PLATFORM

IT'S GOOD FOR BEGINNER

WITH LOW SPREAD AS 0.0 PIPS

Comments

Post a Comment