US Dollar Eyes Trump, Xi Meeting at G20 Summit for Its Next Move

TALKING POINTS – G20, TRADE WAR, TRUMP, XI, EURO, CPI, ECB

- US Dollar eyeing Trump, Xi meeting at G20 summit for its next move

- Trade war de-escalation may hurt Yen, boost Aussie and Kiwi Dollars

- Euro unlikely to find a potent catalyst in November CPI inflation data

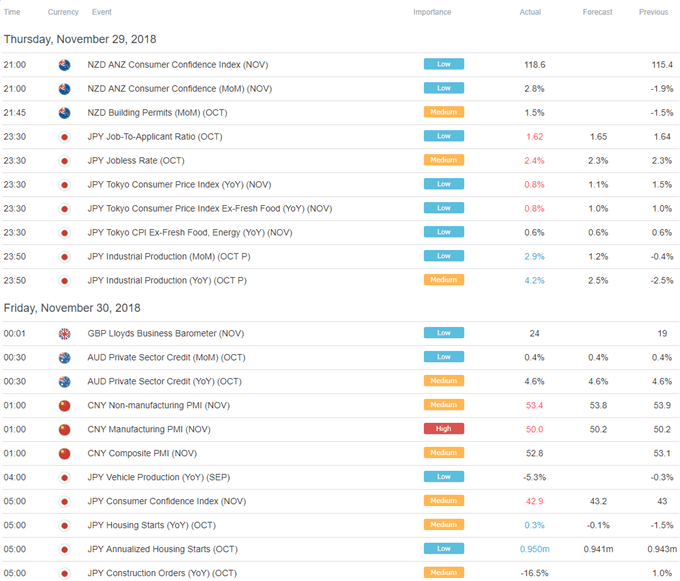

Currency markets marked time in Asia Pacific trade as all eyes turn to Argentina, where a G20 leaders’ summit is getting underway. Traders were seemingly leery of committing one way or another before the conclave, which they hope will bring de-escalation in the trade war between the US and China. President Donald Trump floated the possibility of a deal ahead of his sit-down with counterpart Xi Jingping.

Soundbites from preliminary discussions between US and Chinese officials suggested a pause in tit-for-tat tariff hikes may be agreed, setting the stage for more substantive negotiations to follow. Such an outcome has scope to boost risk appetite, boosting the cycle-sensitive Australian and New Zealand Dollars while weighing on the anti-risk Japanese Yen.

The response form the US Dollar may be most interesting however. It has demonstrated an ability to capitalize on yield appeal when a hopeful turn in global growth bets buoys Fed rate hike prospects as well as haven demand when trade tensions heat up. How the benchmark unit performs once the summit’s outcome is revealed might prove to set the stage for which of these dynamics dominates going forward.

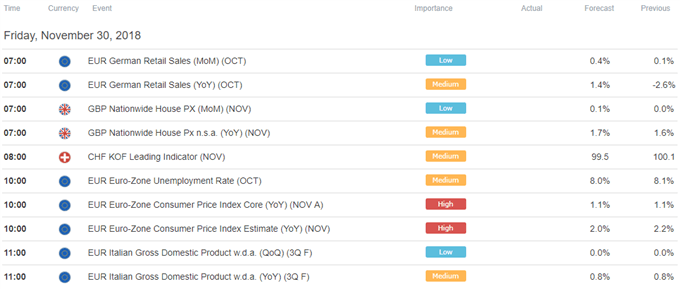

EURO UNLIKELY TO FIND FUEL IN CPI DATA

Eurozone CPI data headlines the economic calendar in European trading hours. The headline inflation rate is expected to tick down to 2 percent in November after setting a six-year high at 2.2 percent in the prior month. As with analogous German data yesterday however, the release seems unlikely to mean much for near-term Euro price action.

That is because of the outcome’s limited implications for the immediate trajectory of ECB monetary policy. The central bank is essentially on autopilot through year-end as it winds down QE asset purchases and a subsequent rate hike seems distant at best. Indeed, priced-in policy bets suggest markets don’t expect to see rates rise at least through November 2019.

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

________________________________________________________________________

______________________________________________________________

Comments

Post a Comment