How Much More Can S&P 500 Rise, USD Fall after Very Cautious Fed?

FED, S&P 500 AND US DOLLAR TALKING POINTS

- After relatively dovish Fed, S&P 500 may struggle finding further reasons to rally

- What does it mean if external headwinds abate while US economy maintains pace?

- The equity risk premium in the US is still low, AUD/USD and NZD/USD are at risk

The Federal Reserve’s most recent monetary policy announcement and accompanying press conference from Chair Jerome Powell caught the US Dollar off guard as Wall Street soared. In short, the central bank continued emphasizing its cautious data-dependent approach. Anticipated adverse impact from the US shutdown and external risks such as slowing global growth, trade wars and a hard Brexit were noted as potential headwinds.

Towards the end of last year, worries about policy tightening resulted in the S&P 500 ending 2018 more than 6% lower. Now, market expectations of a hike this year plummeted as chances of a cut increased. This was supportive for the pro-risk Australian and New Zealand Dollars. They largely outperformed against the Greenback as equities in Asia and Europe rebounded in January.

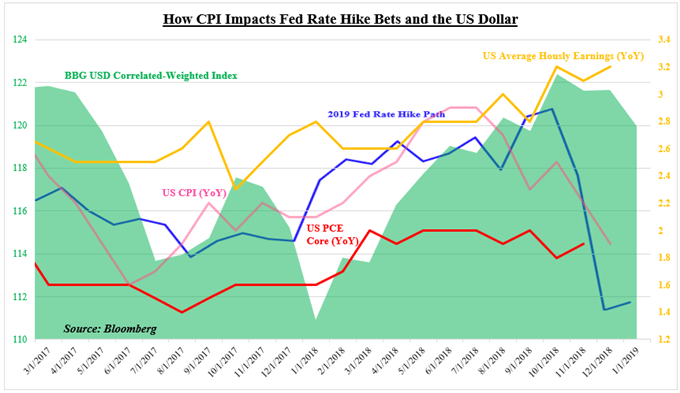

With that in mind, where does this leave sentiment and where can it go form here? Let us not forget that the US economy is generally in a good place for the Fed. Unemployment is low and inflation is more-or-less within the central bank’s target. While headline CPI has been trending lower, average hourly earnings have been on the rise (see chart below).

So, if the economic situation in the US may be supportive of Fed rate hikes, how about the external risks? The US and China are still holding trade talks and if a deal is reached, the former may not raise tariffs further. In recent weeks, the British Pound has been rising as chances of a no-deal Brexit fell while those of a second referendum rose. Mr. Powell also noted that in Q2, lost GDP from the shutdown should be regained.

All else being equal, this could make it trickier for equities to continue paring losses from last year’s decline. On the one hand, if global growth is slowing and that permeates into the world’s largest economy, that could trigger panic and send AUD/USD and NZD/USD lower given the greenback’s status as a safe haven. On the other hand, if external headwind frets abate, does that mean that the central bank can proceed with hiking?

On the next chart below is the relationship between the US Dollar (candles), S&P 500 (green line) and the implied 2019 Fed rate hike path (blue line). The latter is calculated by taking the difference between the yield in Fed funds futures at the beginning of 2020 from the beginning of 2019. If the central bank reopens the door to gradually lifting interest rates, the S&P 500 might fall as USD gains and the blue line rises.

DXY DAILY CHART

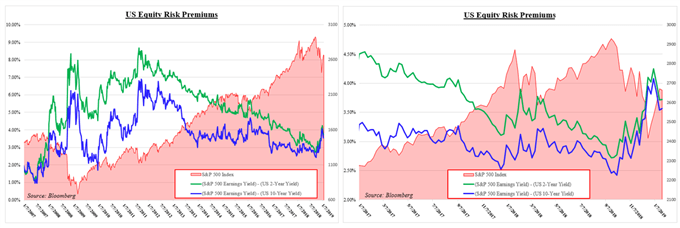

Another warning sign that may come to haunt US stocks in the future is the declining equity risk premium. In short, that is the advantage the S&P 500 has over government bond yields from a perspective of expected stock returns (earnings yield). Back in October, I noted that the equity risk premium in the US has been on the decline and sure enough, this preceded December’s downturn.

A falling equity risk premium may send investors looking for higher returns elsewhere. Looking at the last chart below, the roughly 20% decline in the S&P 500 during Q4 2018 helped push the equity risk premium higher as bond yields tumbled. Since the beginning of January, not only has that been back on the decline, but the equity risk premium remains low by historical standards.

As that aims lower again, the S&P 500 and US benchmarks stock indexes may struggle to find further room to rally. On top of that, if global economic conditions do improve, that would hypothetically incentivize domestic investors to seek returns abroad again. In the end, monetary policy is arguably the most influential force for a currency. Perhaps it won’t be too long until the US Dollar finds a bid again as rates rise.

BEST XM OFFER OF FREE $30 TRADING BALANCE PROFIT WITHDRAWAL

LOW SPREAD AS 0.0 PIPS

Comments

Post a Comment