Most Asia Stocks Rise. US-China Trade Talks Next, S&P 500 May Fall

ASIA PACIFIC MARKETS WRAP TALKING POINTS

- Asia stocks follow Wall Street higher after relatively dovish Fed bolsters sentiment

- ASX 200 declined alongside financials, AUD/USD saw minor gains on China PMI

- President Donald Trump, Vice Minister Liu He have trade talks. S&P 500 might fall

As anticipated, Asia Pacific benchmark stock indexes generally followed Wall Street higher on the backdrop of a relatively dovish Fed. The central bank dropped the reference to further gradual rate increases and Fed Chair Jerome Powell said that the case for increasing benchmark lending rates weakened. This also weighed against the US Dollar as government bond yields tumbled.

In Japan, the Nikkei 225 climbed about 1.20% and China’s Shanghai Composite rose roughly 0.70% heading into the close. South Korea’s KOSPI increased by 0.40%. Australia’s ASX 200 meanwhile fared worse, contracting 0.37%. Losses were led by the Commonwealth Bank of Australia alongside financials which account for a third of the index.

Looking at foreign exchange markets, the pro-risk Australian and New Zealand Dollar aimed cautiously higher. AUD/USD rose after better-than-expected Chinese Manufacturing PMI data, but follow-through was lacking. Despite the beat, the numbers still indicate contraction. Understandably, the greenback weakened a little bit.

Over the remaining twenty-four hours, US PCE inflation data has been pushed back, placing the focus on trade negotiations. President Donald Trump and China’s Vice Premier Liu He are scheduled to meet at 3:00pm EST (20:00 GMT). Risks for stock markets seem to be tilted to the downside given that last week, investors took bets of a positive outcome on negotiations.

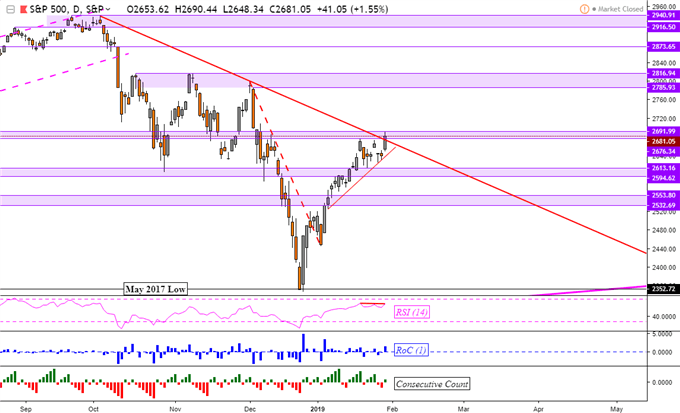

S&P 500 TECHNICAL ANALYSIS

The S&P 500 had closed above a descending resistance line going back to October 2018, but prices remained within a range of resistance between 2,691 and 2,676. Meanwhile, negative RSI divergence shows that upside momentum is fading which at times can precede a turn lower. Sometimes this is not necessarily the case like with what happened in the Dow Jones. Resumption of the dominant downtrend has the index eyeing a near-term rising support line from earlier this month.

S&P 500 Daily Chart

BEST XM OFFER OF FREE $30 TRADING BALANCE PROFIT WITHDRAWAL

LOW SPREAD AS 0.0 PIPS

Comments

Post a Comment