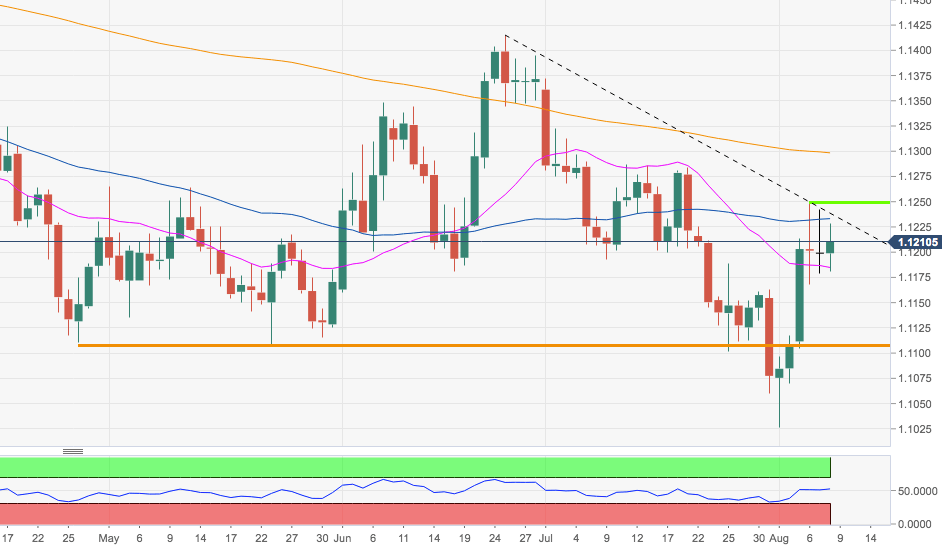

EUR/USD Forecast: Extra consolidation could spark a move lower

- Upside in EUR/USD failed in the 1.1250 region so far.

- Focus remains on US-China trade war, ‘flight-to-safety’ mood.

- Lack of serious upside traction could prompt sellers to turn up.

EUR/USD keeps the consolidative mood well and sound for yet another session today, echoing the broad-based cautious mood in the global markets in a context where the ‘flight-to-safety’ stance still rules, albeit with somewhat less

As usual in past hours, (exaggerated?) concerns over the impact of the US-China protracted trade conflict on the prospects of global growth keep bond yields in the G-10 universe under heavy pressure and maintain firm the demand for the safe haven assets, namely CHF, JPY, Gold.

The continuation of the consolidative stance in EUR/USD coupled with the inability to re-test/surpass recent tops in the mid-1.1200s in the short term carries the potential to encourage EUR-bears to return to the markets and spark the resumption of the underlying bearish trend. In this case, immediate contention appears in the 1.1100 neighbourhood ahead of YTD lows at 1.1026 (August 1). On the upside, when/if spot regains 1.1250 and above, the 1.1280/90 band should emerge on the horizon. Above this region, the downside pressure is expected to diminish somewhat.

Interestingly you write, I will address you'll find exciting and interesting things on similar topics. convert $10

ReplyDelete