Top Trade Idea 2019: Short USD/JPY as Bullish USD Bets Unwind

The Japanese Yen closed out 2018 the way it begun against the greenback, hovering around 112.50-113.00. Throughout the majority of 2018 the impact of trade wars had largely seen the USD strengthen as US markets had been largely insulated from the effects with US growth accelerating following fiscal impulses.

However, the final quarter had seen US growth dynamics begin to deteriorate, which is likely to increase in 2019. Alongside this, as fiscal impulses begin to fade and turn into a drag on the US (twin deficit fears with large fiscal and trade deficits) the effects from trade wars may no longer support the US dollar, thus losing the safe haven battle against the Japanese Yen on investor repatriation.

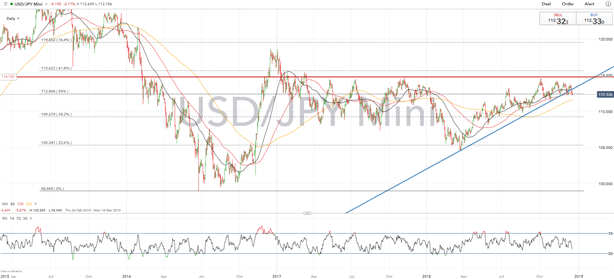

USD/JPY PRICE CHART: DAILY TIMEFRAME (JANUARY 2015 TO DECEMBER 2018)

Remarkably, in light of the plunge in equity markets and deterioration of economic data at the backend of 2018, USDJPY had remained stubbornly rangebound. However, we think that going into 2019, concerns surrounding a slower pace of Fed rate hikes, twin deficits and weakening fundamentals will increase downside risks to the USD. Given that speculators are heavily long USDJPY (over $10bln), this leaves the pair vulnerable to a sizeable shift as bullish bets unwind. Initial target at 110.00 with a final target of 105.00.

TRADE BINARY OPTION WITH IQ OPTION

______________________________________________________________

Comments

Post a Comment