British Pound at Key Chart Barrier Before Bank of England Meeting

TALKING POINTS – BANK OF ENGLAND, BRITISH POUND, YEN, US DOLLAR, GBP/JPY

- Grim BOE may clash with hawkish shift in priced-in policy bets

- Brexit uncertainty, global weakness may overshadow UK data

- Downbeat tone may trigger broader risk aversion, boosting Yen

All eyes are on the Bank of England as traders brace for so-called “Super Thursday”, when it will issue a rate decision as well as issue minutes from the latest meeting of the policy-setting MPC committee and publish an updated quarterly Inflation Report (QIR). Governor Mark Carney will also hold a press conference to explain what all of this means for market participants.

A meaningful change in the official policy stance – be it the current setting of the benchmark Bank Rate or the forward guidance on offer – seems unlikely. Officials are likely to remain noncommittal as Brexit uncertainty continues to cloud the near- to medium-term outlook. The updated set of economic forecasts within the QIR report may have market-moving potential however.

UK economic news-flow has markedly improved relative to baseline forecasts over recent months. The markets have noticed: a meaningful hawkish shift in the priced-in 2019 policy path since late March now puts the probability of a rate hike before year-end at over 60 percent. The global growth backdrop has remained downbeat however, to say nothing of lingering political jitters at home and abroad.

This might set the stage for disappointment. The British Pound may fall if Mr Carney and company display a more downbeat disposition than investors are positioned for. Such an outturn may also bode ill for overall sentiment trends, stoking concerns about a downturn in the global business cycle and offering an outsized lift to the anti-risk Japanese Yen and US Dollar.

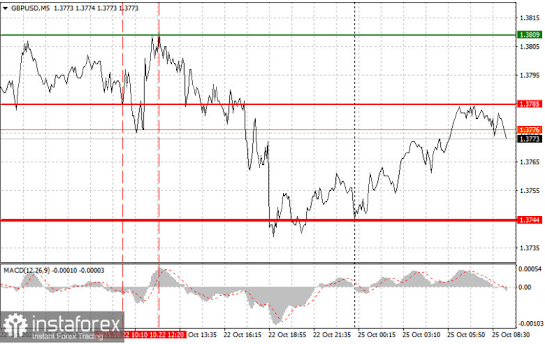

CHART OF THE DAY – GBP/JPY AT KEY RESISTANCE BEFORE BOE RATE DECISION

GBP/JPY seems like a natural catch-all place to look for the influence the BOE policy call on Sterling’s fortunes and that of market-wide risk appetite. Tellingly, prices put in a Shooting Star candlestick at near-term trend resistance just ahead of the announcement, implying indecision after an upswing and hinting that a turn lower may be in the cards.

Needless to say, such a move would fit in neatly within the foregoing fundamental analysis framework. Initial support is in the 143.79-144.84 congestion area, with a break below that confirmed on a daily closing basis opening the door for a test below the 142.00 figure. Alternatively, a breach above resistance – now at 145.87 – puts the now-familiar range top in the 148.57-149.72 zone back in focus.

Comments

Post a Comment